Eligibility Requirements for USDA Loans Do you qualify?

Table of Content

An order for a job or project under the job order contract must be signed by the board's representative and the contractor. The order may be a fixed price, lump-sum contract based substantially on contractual unit pricing applied to estimated quantities or may be a unit price order based on the quantities and line items delivered. The board shall advertise for, receive, and publicly open sealed proposals for job order contracts. The board or its representative shall select the offeror that submits the proposal that offers the best value for the institution based on the published selection criteria and on its ranking evaluation. If the board or its representative is unable to negotiate a satisfactory contract with the selected offeror, the board or its representative shall, formally and in writing, end negotiations with that offeror and proceed to negotiate with the next offeror in the order of the selection ranking until a contract is reached or negotiations with all ranked offerors end.

The VA appraisal can only be completed by a VA-approved appraiser to verify the property meets minimum VA property standards. Appraisal waivers aren’t permitted for VA loans as they are for conventional mortgages. The VA calculates how much extra money is left over in a veteran household after standard paycheck deductions and a maintenance expense calculator based on the square footage of the home. The result is called “residual income,” and the amount required varies based on where you live and the size of your family.

Home Loan Programs Available In:

There you will find 60 actual business plans and financial information and online classes. The Entrepreneur Centers provide access to more than 20 financing programs and a network of organizations providing counseling, training and assistance to start-up and existing entrepreneurs. TheRural Development Council supports the development of rural communities across the state through collaboration between government and nonprofit and private sectors. The lender is required to protect the value of the asset, which includes proper use of reserves to protect the financial interest of the property. The lender has the discretion to use the reserves if it is in the best financial interest of the property (Handbook , Chapter 7 Section 7). Effective March 31, 2020, until September 30, 2020, lenders may offer 180-day loan payment deferrals without prior agency approval for Rural Energy for America Program Loan Guarantees.

Retain in the operator's records a copy of the documentation required or issued under Subsection for each employee until the second anniversary of the examination date. "Training and examination program on sexual abuse and child molestation" means a program approved by the department under Subsection . The Texas Higher Education Coordinating Board may adopt rules necessary to administer this section. Not later than January 1 of each odd-numbered year, each institution of higher education shall submit a written report regarding the institution's compliance with this section to the governor, the lieutenant governor, the speaker of the house of representatives, and the presiding officer of each legislative standing committee with primary jurisdiction over higher education. The governing body of the institution shall designate an administrator to be responsible for ensuring implementation of this section. The administrator may assign duties under this section to one or more administrative employees.

Our content engages millions of readers in 75 countries every day

USDA opened a second application window for funding under the Distance Learning and Telemedicine grant program. Electronic applications for window two may be submitted through grants.gov beginning April 14, 2020 and are due no later than July 13, 2020. USDA extended the application deadline for the ReConnect Pilot Program to April 15, 2020. USDA extended the application deadline for the Rural Energy for America Program to April 15, 2020. USDA extended the application deadline for the Rural Business Development Grant program to no later than April 15, 2020. USDA extended the FY21 application deadline for the Value-Added Producer Grant Program to May 4, 2021.

The funds shall either be deposited in the depository bank or banks or invested as authorized by Chapter 2256, Government Code . Funds that are to be deposited in the depository bank or banks must be deposited within seven days from the date of receipt by the institution. Normally, you can take a mortgage loan for a longer duration and pay off your repayment by using smaller monthly EMIs. You can also go to the nearest branch, request for an application, and submit it along with the required documents.

EDND/Commerce Developer Day August 24, 2023 - SAVE THE DATE!

Except as provided in Subsection , an institution of higher education that determines it is in its best interest to reappoint a faculty member for the next academic year shall offer the faculty member a written contract for that academic year not later than 30 days before the first day of the academic year. A governing board may not waive the evaluation process for any faculty member granted tenure at an institution. "Residential advisor" means a student who is employed by a public or private institution of higher education to serve in an advisory capacity for students living in a residential facility. Each advisor or officer required by Subsection to attend a program shall report on the program's contents at a meeting of the full membership of the student organization the advisor or officer represented at the program.

No, the USDA doesn’t have a pest inspection requirement, so unless your lender, appraiser, or state or local law requires it, a pest inspection is not necessary. Turn times and costs for USDA appraisals can vary depending on where you’re buying and more. They’ll assess the property’s fair market value in part by looking at recent comparable home sales in the area, which are commonly known as “comps”. If you’re financing a property, your lender typically owns 80 to 100 percent of what you’re “buying,” at least until you pay off that loan in full. They want to make sure that if you fail to pay back the loan, they can sell the property for enough money to cover their losses.

This section does not prohibit an institution of higher education from entering into a contract with a faculty member for a period longer than an academic year. An institution of higher education may not administer or sponsor a debit card program for students of the institution that does not conform to this section. If the institution publishes a general catalogue, student handbook, or similar publication, it shall publish a summary of the provisions of Subchapter F, Chapter 37, in each edition of the publication. An institution of higher education shall honor an assignment, pledge, or transfer fulfilling the conditions of Subsection without incurring any liability to the employee executing the assignment, pledge, or transfer. Payment to any assignee, pledgee, or transferee in accordance with the terms of the instrument is payment to or for the account of the assignor, pledgor, or transferor. An assignment, pledge, or transfer is enforceable only to the extent of salary due or that may become due during continuation of the assignor's employment as an employee of the institution.

If a fixed contract amount or guaranteed maximum price has not been determined at the time the contract is awarded, the penal sums of the performance and payment bonds delivered to the institution must each be in an amount equal to the project budget, as set forth in the request for qualifications. The board shall select the construction manager-at-risk in either a one-step or two-step process. The board shall state the selection criteria in the request for proposals or qualifications, as applicable. The selection criteria may include the offeror's experience, past performance, safety record, proposed personnel and methodology, and other appropriate factors that demonstrate the capability of the construction manager-at-risk. If a one-step process is used, the board may request, as part of the offeror's proposal, proposed fees and prices for fulfilling the general conditions.

An affidavit signed by the student stating that the student declines the vaccination for bacterial meningitis for reasons of conscience, including a religious belief, or confirmation that the student has completed the Internet-based process described by Subsection (d-3) for declining the vaccination on that basis, if applicable to the student. A student who previously attended an institution of higher education or private or independent institution of higher education before January 1, 2012, and who is enrolling in the same or another institution of higher education or private or independent institution of higher education following a break in enrollment of at least one fall or spring semester. The cost of such English proficiency course as determined by the coordinating board shall be paid by the faculty member lacking proficiency in English.

If a campus peace officer elects to appeal the institution's action to an independent third party hearing examiner under this section, the officer or institution may appeal the examiner's decision to a district court only as provided by Subsection . The coordinating board shall give due consideration to the geographical proximity and number of institutions of higher education to be included within a proposed region. In consultation with institutions of higher education, the comptroller by rule may establish minimum requirements for notice to owners of unclaimed money deposited in the unclaimed money fund and for charges for that notice. The rules may not provide stricter requirements than the comptroller applies for amounts of less than $25 in the custody of the comptroller under Chapter 74, Property Code.

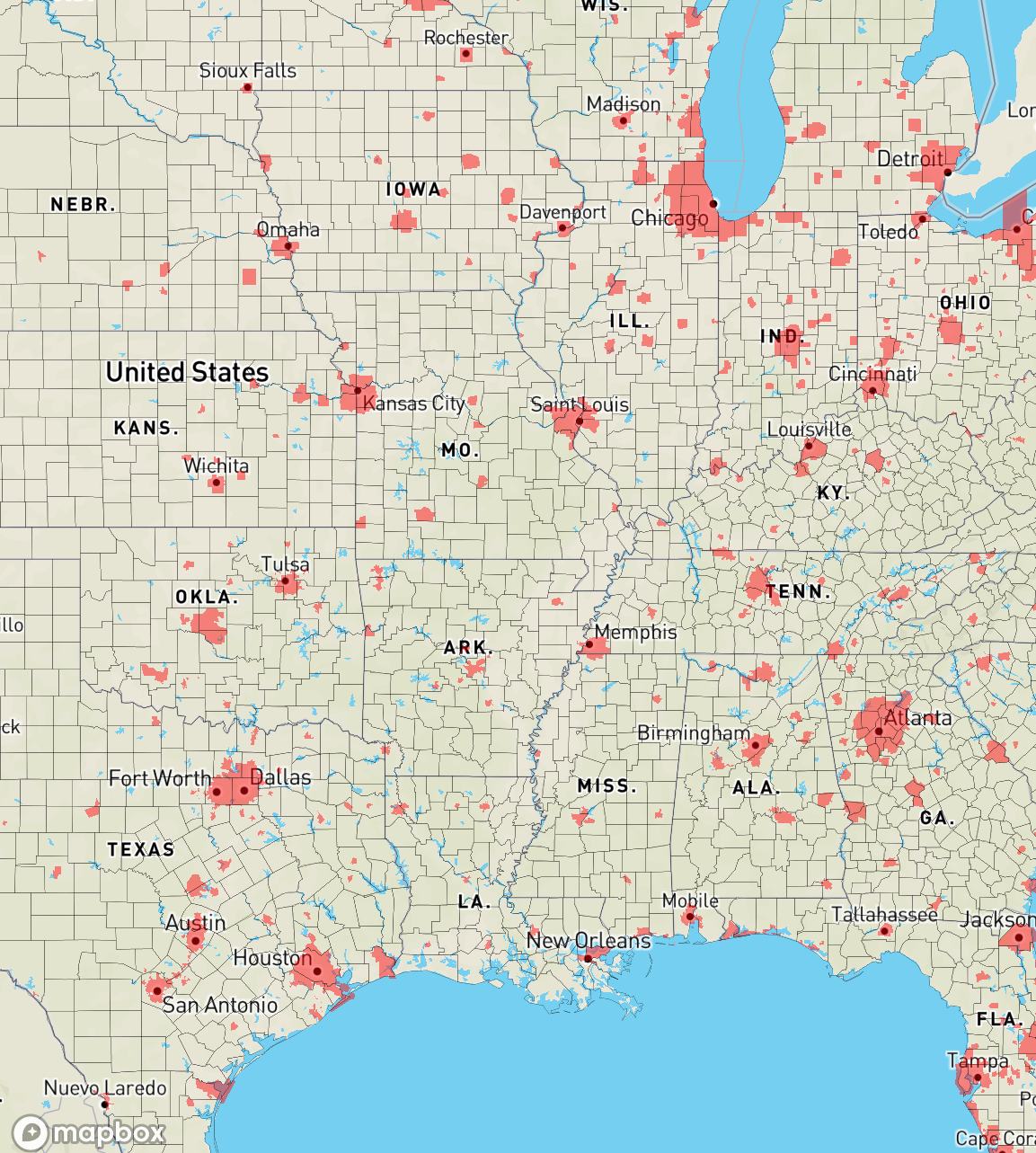

To be eligible for a USDA loan, applicants must meet the basic eligibility requirements set forth by the USDA, which cover credit, income, property usage and home location. Department of Agriculture are designed to help low- to moderate-income borrowers buy homes in eligible rural areas with no down payment. However, strict income, location and square footage limits typically result in maximum loan amounts well below the current FHA and conforming loan limits. However, you may need reserves equaling three to six months of your monthly payments if you’re buying a multi-unit property or renting out your current home while purchasing a new one. Instead, you’ll pay a VA funding fee between 1.40% and 3.60% depending on your down payment and whether you’ve used your home loan benefits before.

Comments

Post a Comment